Imagine walking into a local vegetable market in India. One seller offers tomatoes for ₹40 per kilo, while another shop sells the same tomatoes for ₹50 per kilo. If you buy from the cheaper seller and sell at the higher price, you make a profit.

This is exactly how trading works. The only difference is that here, instead of tomatoes, we are dealing with Bitcoin.

Bitcoin is a digital currency that exists only online. If you’re new to crypto in general, you can first check out our detailed guide on What Is Cryptocurrency and How Does It Work in India? (2025 Beginner’s Guide)

to understand the basics of how digital currencies operate in India.

You can buy and sell it through Indian crypto exchanges like WazirX, CoinDCX, or ZebPay. The goal is simple: buy Bitcoin at a lower price and sell it at a higher price.

Table of Contents

1. What Is Bitcoin Trading and How Does It Work for Beginners in India?

If you’d like to understand Bitcoin itself — its history, creator, and how it became the world’s first cryptocurrency — you can read our beginner-friendly post on What is Bitcoin? A Beginner’s Guide to the First Crypto.

If you are a beginner, you may wonder: What Is Bitcoin Trading and How Does It Work for Beginners?

Bitcoin trading is the process of buying and selling Bitcoin with the aim of making a profit. In India, this happens on crypto exchanges where you deposit INR and exchange it for Bitcoin.

Here’s how it works for beginners:

- You deposit INR in your exchange account.

- You buy Bitcoin when the price is lower.

- You sell Bitcoin when the price goes higher.

- The difference between buying and selling is your profit (or loss).

In short:

- Buy low, sell high = profit

- Buy high, sell low = loss

2. Is Bitcoin Trading Legal in India?

When beginners ask “What Is Bitcoin Trading and How Does It Work for Beginners,” one of the first doubts they usually have is about legality in India.

To understand this, think of Bitcoin trading like driving a car.

- If you drive on the right road, follow traffic signals, and obey rules → it’s legal.

- If you drive rashly, ignore rules, or break laws → you can get penalized.

Similarly, in India, Bitcoin trading is not illegal. You are allowed to buy, sell, and hold Bitcoin through regulated crypto exchanges. But there are certain “traffic rules” you must follow:

RBI’s Stand

Think of RBI as the traffic authority of the financial roads. It doesn’t drive the vehicles (Bitcoin), but it controls which roads banks can use and under what rules.

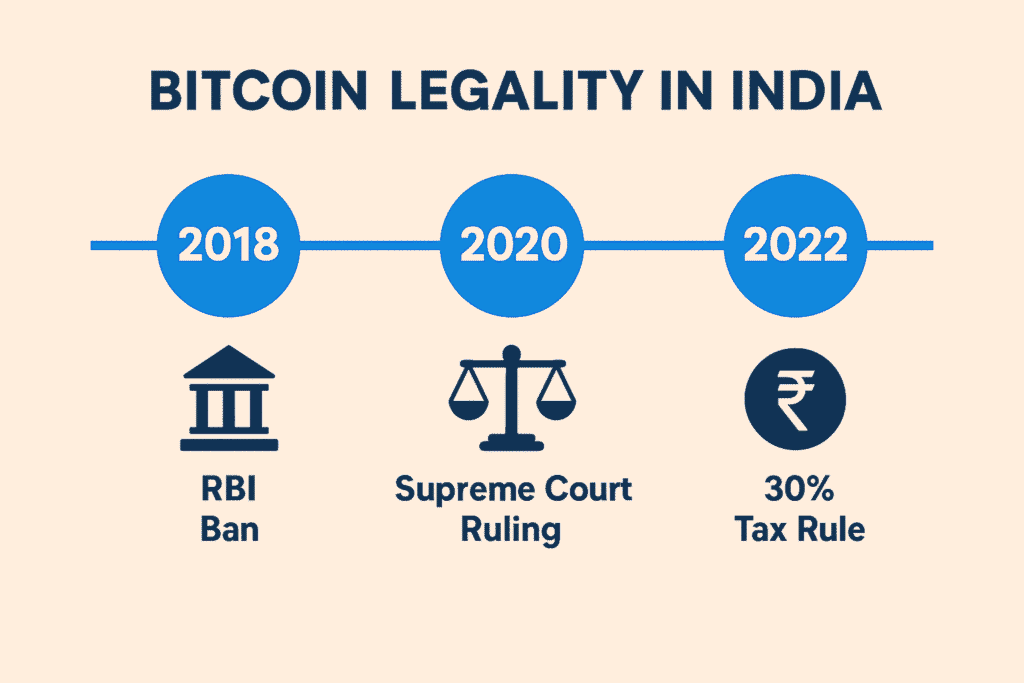

- In 2018, RBI issued a circular directing banks and regulated entities not to provide services to crypto exchanges and participants.

- However, in March 2020, the Supreme Court of India struck down that RBI circular, saying it was unconstitutional to completely cut off banking access without any regulatory framework.

- After that, banking services for crypto exchanges resumed, although the RBI still maintains a cautious stance and considers private digital currencies a potential macroeconomic risk.

- Even today, RBI has not granted Bitcoin the status of legal currency. While you can trade through exchanges after the Supreme Court ruling, RBI and the government continue to caution that private cryptocurrencies pose financial stability risks.

So, you can trade, buy, and hold Bitcoin — but you must do so using permitted banking infrastructure and regulated exchanges.

Taxation & Income Rules

Continuing our analogy, think: whenever you use certain roads, you pay toll. In crypto, the “toll” is taxation.

- The Finance Act, 2022 introduced a regime under Section 115BBH that taxes income from Virtual Digital Assets (VDAs) like crypto at a flat 30% rate.

- No deductions are allowed beyond the cost of acquisition (i.e., transaction fees, or other expenses cannot be fully deducted).

- A 1% TDS (Tax Deducted at Source) is applied on transfers of crypto assets (on the “sale consideration”), to improve transparency.

- Losses from transactions in one crypto (or VDA) cannot be set off against gains from another VDA or any other income source.

- Some platforms suggest that GST (Goods & Services Tax) of 18% may apply on service fees by crypto exchanges (for trading, wallet services) — though the crypto assets themselves are not taxed under GST.

Profits from Bitcoin trading are taxed at 30% flat under Section 115BBH, plus a 4% cess. A 1% TDS is applied on most transactions. Losses from one crypto cannot be set off against another. GST of 18% may apply on exchange service fees (like trading commissions), but not on Bitcoin itself.

Regulation Status & Legal Recognition

Finally, think of this as whether the road you’re driving on is fully legalized, half-legal, or unregulated.

- Cryptocurrencies are not banned in India. Holding, buying, selling, exchanging crypto is legal.

- Yet, they are not recognized as legal tender — i.e. they cannot replace the Indian Rupee in daily transactions.

- There is no dedicated legislation yet that fully regulates all aspects of crypto — such as exchanges, custody, ICOs, consumer protection, etc.

- As of 2025, there is still no dedicated crypto law in India. A crypto bill was discussed, but recent reports suggest the government is resisting full legalization due to systemic risks.

- Keep AML/KYC compliance point.

So while Bitcoin trading is legal in India, it’s in a careful, tightly monitored environment without full recognition as money.

Summary for Beginners

When a beginner wonders, “What Is Bitcoin Trading and How Does It Work for Beginners in India?”, here’s what to keep in mind:

- Yes, Bitcoin trading is legal — Indian residents can trade crypto via exchanges.

- But you must follow banking rules (RBI guidelines), trade via compliant exchanges.

- Profits are taxed at 30% + 4% cess under Section 115BBH, with a 1% TDS on transactions.

- You can’t offset losses between crypto assets or with other income.

- There’s no legal tender status, no dedicated law yet, and rules may evolve in the future..

3. 5 Easy Steps to Start Bitcoin Trading in India

If you’re wondering “What Is Bitcoin Trading and How Does It Work for Beginners in India?” — here’s the simplest way to understand it. Think of trading Bitcoin like buying and selling gold, but online. You buy it when the price is low and sell it when the price goes up.

Let’s walk through 5 super simple steps to get started

Step 1 – Choose a trusted exchange

A crypto exchange is like an online shop where you can buy and sell Bitcoin using Indian Rupees (INR).

Some popular exchanges in India are WazirX, CoinDCX, and ZebPay.

How to pick the right one?

- See if it supports UPI or bank transfer (easy deposits).

- Check reviews — is it safe and easy to use?

- Start with one that has simple mobile apps for beginners.

Example: Just like you choose Amazon or Flipkart to shop online, here you choose a trusted exchange to “shop” for Bitcoin.

Step 2 – Complete KYC & deposit INR

Before you start buying, you’ll need to verify your identity (KYC). It’s like showing your ID card when you open a bank account.

What you need:

- PAN card (for tax purposes)

- Aadhaar/Passport for address proof

- A selfie for verification

Once KYC is done, you can add money to your account:

- Use UPI, Netbanking, or IMPS.

- Start small (₹500–₹1,000) just to learn.

Step 3 – Learn basic price analysis

Now comes the exciting part — checking Bitcoin’s price.

Don’t worry, you don’t need to be a math genius. Just keep it simple:

- If Bitcoin price is low today compared to the last week, it might be a good time to buy.

- If Bitcoin price has gone up a lot already, it may fall soon — so wait.

Most apps show you green (price going up) and red (price going down) charts.

You only need to understand this much as a beginner.

Example: Just like you check gold price before buying jewellery, here you check Bitcoin’s price chart before buying.

Step 4 – Buy & sell Bitcoin

Time to place your first trade

- Go to the Bitcoin section on your exchange app.

- Enter the amount in INR (like ₹500 or ₹1,000).

- Click Buy — congratulations, now you own Bitcoin!

To sell, it’s just the reverse:

- Click on Sell when you feel the price has gone up enough.

- The INR goes back to your exchange wallet, and you can withdraw it to your bank.

Example: You bought ₹1,000 worth of Bitcoin. After a few days, the value goes up to ₹1,200. You sell it → you just made ₹200 profit.

Step 5 – Secure your Bitcoin safely

This is super important

When you buy Bitcoin, it’s stored in a wallet. Think of it like a digital locker.

- If you keep Bitcoin on the exchange → it’s like leaving money with the shopkeeper.

- If you move it to your own wallet (like Trust Wallet or a hardware wallet) → it’s like keeping money in your own locker.

Tips to stay safe:

- Always enable 2FA (two-step login) in your app.

- Never share your passwords or OTPs.

- Keep long-term Bitcoin in a safe wallet, not just on the exchange.

Example: Would you keep gold jewellery with the jeweller after buying it? No, you’d bring it home or put it in a locker. Same logic applies here.

Final Words for Beginners

As a beginner, it’s easy to think that once you’ve chosen a trusted exchange, everything is completely safe. But here’s the truth: even the safest exchanges are not fully safe.

Why?

- Hacks & technical issues: Exchanges are always online, and hackers target them. In the past, many big exchanges worldwide have been hacked. Even if security is strong, there’s always a small risk.

- Not your keys, not your Bitcoin: When Bitcoin stays on an exchange, you don’t fully control it — the exchange does. If the exchange freezes withdrawals, faces legal issues, or gets hacked, your funds may be stuck.

That’s why experts always say: keep only the money you want to trade on an exchange, and move the rest to your own wallet.

Delayed Payments in India

Another reality beginners must know is: sometimes payments get delayed on Indian exchanges.

- Bank transfers may take longer due to UPI downtime, IMPS/NEFT limits, or banking restrictions.

- During high trading volume (when Bitcoin price is pumping or crashing), exchanges get overloaded and withdrawals can be delayed.

- RBI’s strict monitoring of crypto-related payments sometimes slows down deposits/withdrawals.

Key Takeaway

- Exchanges are convenient, not foolproof. Treat them like busy marketplaces — safe to use, but not a place to keep all your valuables.

- Always withdraw profits to your own bank or personal wallet when possible.

- Be patient with payment delays — they are common in India due to banking and regulatory hurdles.

If you remember this, you’ll stay safer and avoid panic as a beginner.

4. Risks and Challenges in Bitcoin Trading

When beginners search “What Is Bitcoin Trading and How Does It Work for Beginners in India?”, they usually focus on profits. But the truth is, Bitcoin trading also comes with risks. Understanding these challenges early can save you from losses and stress.

Volatility

Bitcoin’s price can move up or down very quickly — sometimes thousands of rupees in minutes.

- This volatility creates opportunities for profit, but also huge chances of loss.

Example: If you buy Bitcoin at ₹30 lakh today, the price could shoot to ₹32 lakh tomorrow — or drop to ₹28 lakh.

Scams & Fake Promises

The crypto world is full of scammers who promise “guaranteed returns” or run fake exchanges.

- Beginners often fall for WhatsApp groups, Telegram signals, or Ponzi schemes.

- Remember: if someone guarantees profit, it’s a red flag.

Regulatory Uncertainty in India

In India, Bitcoin is legal to trade but not recognized as official money.

- RBI doesn’t regulate Bitcoin directly.

- Government taxes profits at 30% flat + 1% TDS, but there’s no clear long-term law yet.

- This uncertainty means rules could change in the future.

Globally, governments and financial regulators are introducing new investment options like Bitcoin ETFs. To learn how these work and how the SEC regulates them, check our Spot Crypto ETFs Guide 2025: SEC Regulations, Benefits, and Risks Explained.

Quick Takeaway for Beginners

- Don’t invest money you can’t afford to lose.

- Trade only on trusted Indian exchanges.

- Be prepared for sudden price swings and payment delays.

- Stay updated on government policies.

5. Tips for Beginners in Bitcoin Trading

If you’re trying to understand what is Bitcoin trading and how does it work for beginners in India, it’s important to know not just how to trade, but how to trade wisely. Here are three simple tips, explained with everyday examples

Start Small – Like Learning to Swim

When you learn swimming, you don’t jump straight into the deep end. You start in the shallow pool with floaters.

Similarly, in Bitcoin trading, start with a small amount (₹500–₹1,000). This way, even if you make mistakes, you won’t drown financially.

Tip: Treat your first few trades as practice, not as a money-making mission.

Avoid FOMO – Like Missing a Train

Imagine you’re at a station and a train leaves without you. Do you run blindly on the tracks to catch it? Of course not — that’s dangerous. You wait for the next train.

In Bitcoin trading, FOMO (Fear of Missing Out) is the same. If Bitcoin suddenly jumps in price, don’t panic and buy at the top. The market always gives another chance.

Tip: Stick to your plan, don’t chase pumps. Patience saves beginners from big losses.

Keep Learning – Like Driving a Car

When you first learn driving, you don’t master highways on day one. You start with basic controls, then slowly learn traffic rules, signals, and safe driving habits.

Bitcoin trading is the same. Keep learning about charts, strategies, taxes, and security. The more you practice and study, the smoother your trading journey becomes.

Tip: Follow trusted blogs, YouTube channels, or courses to keep upgrading your skills.

Beginner’s Takeaway

- tart small → like learning in the kiddie pool.

- Avoid FOMO → don’t run after every train.

- Keep learning → trading is a skill, like driving.

If you follow these simple habits, Bitcoin trading will feel less like gambling and more like a well-planned journey.

Conclusion

If you’ve been asking yourself what is Bitcoin trading and how does it work for beginners in India, the answer is simple: it’s just like buying and selling any asset — but online, and with higher risks and rewards.

Bitcoin trading is legal in India, but it comes with challenges like volatility, scams, and payment delays. That’s why beginners should always start small, learn step by step, and never invest more than they can afford to lose.

Remember: even the safest exchanges are not fully safe. Treat them as a place to trade, not to store all your money. The real key is to stay patient, avoid FOMO, and keep learning.

Trading Bitcoin is not a shortcut to riches — it’s a journey. Walk carefully, follow the rules, and you’ll slowly build both confidence and knowledge in this new digital market.

FAQs (Frequently Asked Questions)

Q1. How to trade Bitcoin in India for beginners?

You can trade Bitcoin in India by signing up on a trusted crypto exchange (like WazirX, CoinDCX, or ZebPay), completing KYC, adding INR via UPI/Bank Transfer, and then buying/selling Bitcoin directly on the app.

Q2. Can I invest ₹100 in Bitcoin?

Yes. Most Indian exchanges allow you to start with as little as ₹100. Since Bitcoin is divisible into smaller units (called satoshis), you don’t need to buy a full Bitcoin.

Q3. How to convert Bitcoin to cash in India?

To cash out, you can sell your Bitcoin on an Indian exchange → the INR will reflect in your exchange wallet → then you can withdraw it to your linked bank account. Sometimes withdrawals may take a few hours or a day depending on the bank and exchange.

Q4. Who has the most Bitcoin in India?

There’s no official data, but some of the largest Indian crypto exchange founders and early adopters are believed to hold the most Bitcoin. Individual holdings are private, so no one can confirm exactly who has the maximum.

Q5. What is the minimum rupees to invest in Bitcoin?

Minimum investment is usually ₹100–₹500, depending on the exchange you use. Beginners often start small to understand the process before investing larger amounts.

Q6. How much of my income should I invest in Bitcoin?

Experts suggest not more than 5–10% of your total savings or income should go into Bitcoin or crypto. Always keep the majority of your money in safer assets (FDs, mutual funds, gold) and use only extra money for crypto.

Q7. How long do you have to hold Bitcoin before selling?

There’s no fixed rule. Some people trade daily, while others hold for months or years. If you’re a beginner, it’s better to hold for the long term (6–12 months or more) instead of chasing quick profits.

Q8. Is it too late to buy Bitcoin?

No. Bitcoin is still evolving and its adoption is growing worldwide. Prices may look high compared to earlier years, but many experts believe Bitcoin still has long-term potential. Just remember: start small, and don’t invest money you can’t afford to lose.

Quick Disclosure

This article is for educational purposes only and not financial advice. Bitcoin trading in India involves risks, and rules may change. Always do your own research and consult a financial advisor before investing. Read Full Disclaimer Here.

![Read more about the article What Is Cryptocurrency and How Does It Work in India? [2025 Beginner’s Guide]](https://cryptomonkx.com/wp-content/uploads/2025/10/what-is-cryptocurrency-and-how-does-it-work-in-india-featured-image-300x200.png)