Personal finance mistakes are the silent killers of wealth. You may be working hard and earning a decent income, yet still feel like money slips away faster than it should. The problem often isn’t how much you make—it’s the hidden money habits that quietly drain your bank account.

The good news? Building wealth doesn’t always require drastic changes. By avoiding a handful of common money mistakes—like overspending, skipping investments, or neglecting a budget. you can create a strong financial foundation and accelerate your path to financial freedom.

In this blog, we’ll uncover the 10 biggest financial mistakes to avoid that keep people broke, and more importantly, how you can avoid them to secure a wealthier future.

Table of Contents

1. Budgeting Mistakes: Living Without a Budget

Have you ever wondered why your paycheck disappears before the month ends—even when you’re earning more than before? That’s the classic trap of living without a budget. It’s like sailing without a map: you may move forward, but you have no idea where you’re headed.

A budget isn’t about restriction; it’s about direction. It shows you where your money is going, helps you avoid overspending, and ensures you’re putting enough aside for savings, investments, and emergencies. Skipping this step is one of the most common personal finance mistakes beginners make. Here’s what a budget really means and why it matters.

Why It’s a Problem

Without a budget, you risk:

- Overspending on small daily expenses (like coffee, food delivery, subscriptions).

- Having no visibility on “leaks” in your finances.

- Struggling to build savings or investments because you’re always reacting, not planning.

“According to a 2025 LendingClub + PYMNTS study, about 62% of Americans say they live paycheck to paycheck—including many earning $100,000+. Surveys using stricter definitions of necessity spending suggest a smaller share of households use nearly all their income for essentials.

Real-Life Example

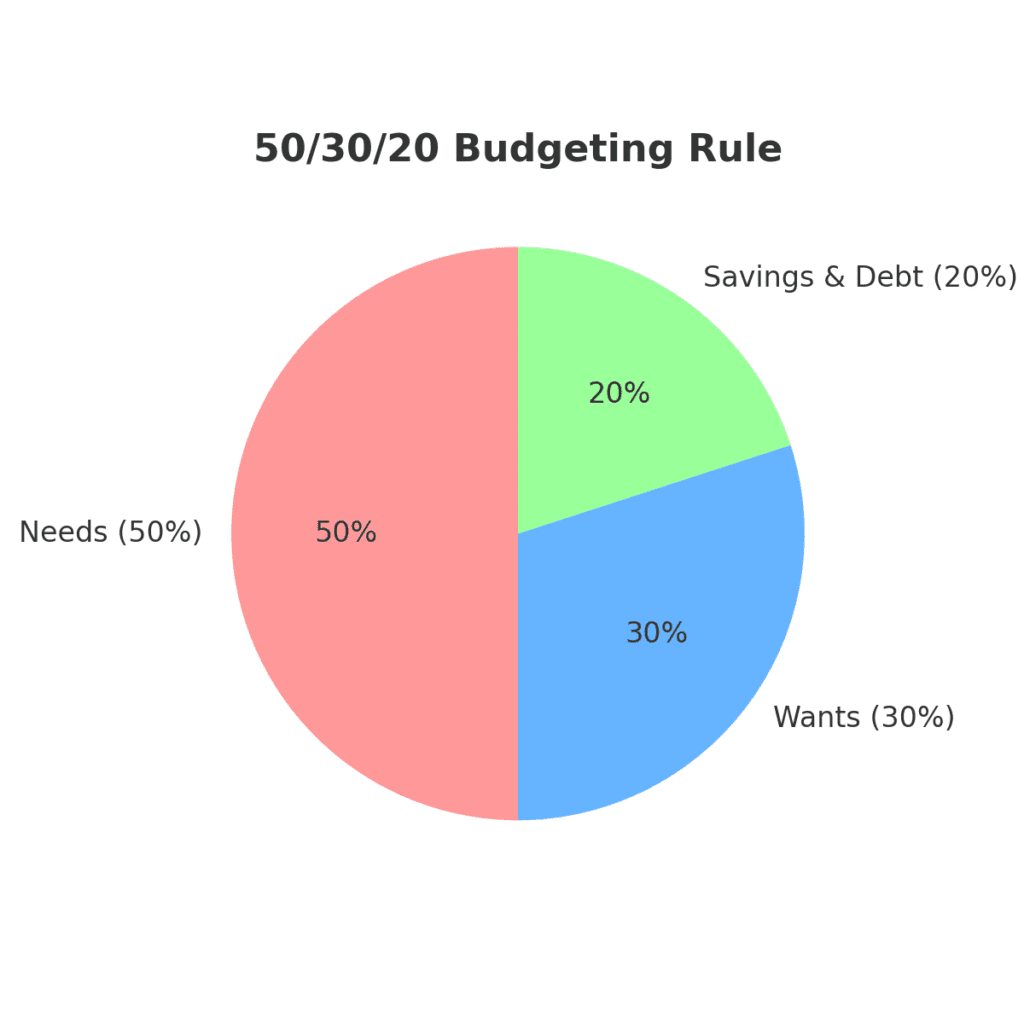

Take Priya, a 28-year-old marketing executive. She earned a decent salary but had no budget. At the end of every month, she was shocked to see her account nearly empty. After tracking her expenses, she realized food delivery and online shopping were eating away nearly 25% of her income. Once she started budgeting with the 50/30/20 rule, she managed to save an additional ₹10,000 every month without feeling deprived.

Expert Insight

As financial expert Dave Ramsey once said: “A budget is telling your money where to go instead of wondering where it went.” A budget gives you control, not limitations.

How to Avoid This Mistake

Track your income and expenses using a simple spreadsheet or an app like Mint or YNAB.

Start with the 50/30/20 rule:

- 50% → Needs (rent, food, bills)

- 30% → Wants (shopping, dining, travel)

- 20% → Savings & debt repayment

Review your budget weekly. Adjust if you overspend in one category.

Celebrate small wins—like saving your first extra $100—because momentum matters.

2. Ignoring an Emergency Fund

What happens if tomorrow your car breaks down, you lose your job, or a sudden medical bill arrives? For most people, the answer is the same—they reach for a credit card or a loan. That’s why ignoring an emergency fund is one of the most dangerous personal finance mistakes. It leaves you vulnerable to debt every time life throws a curveball.

An emergency fund is simply a financial safety net—money set aside for unexpected events. Without it, even small surprises can spiral into financial stress. Investopedia explains it as a financial safety net.

Why It’s a Problem

Without an emergency fund, you may:

- Depend on high-interest credit cards during emergencies.

- Struggle with anxiety because you’re unprepared for the unexpected.

- Derail your long-term financial goals by dipping into retirement or investment accounts.

“According to Bankrate’s 2025 Annual Emergency Savings Report, 41% of U.S. adults say they would use their savings to pay for a $1,000 emergency expense—down from 44% in 2024, indicating that fewer people feel financially prepared.

Real-Life Example

Rahul, a 32-year-old IT professional, ignored building an emergency fund because he thought his stable job was enough security. When his company downsized, he had to rely on credit cards to cover three months of expenses. By the time he found a new job, he was already ₹2 lakh in debt. If he had saved even three months’ worth of expenses, he could have avoided the financial setback.

Expert Insight

As Suze Orman wisely says: “Emergency funds are like insurance—you may not appreciate them until you desperately need them.”

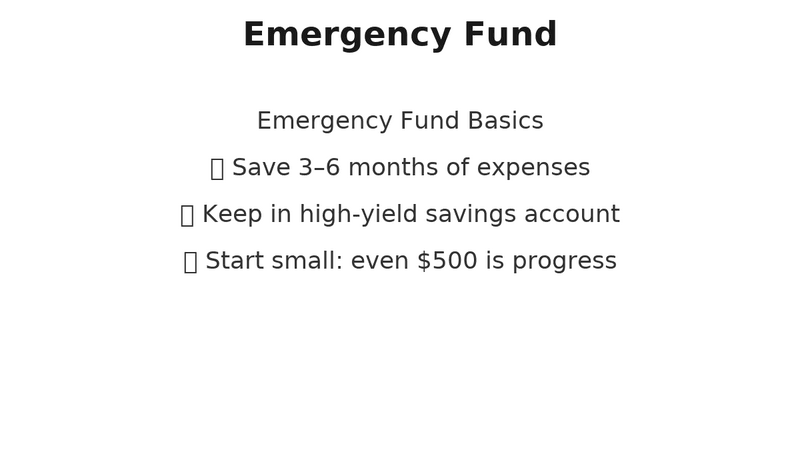

How to Avoid This Mistake

- Start small—set aside even $500 (₹40,000 approx.) as your first goal.

- Gradually build toward 3–6 months of essential expenses.

- Keep the fund in a high-yield savings account (accessible but separate from daily spending).

- Automate transfers each month so saving becomes a habit.

3. Debt Mistakes: Carrying Credit Card Balances

Imagine buying a ₹5,000 gadget today with your credit card. If you only pay the minimum balance each month, you might end up paying nearly double over time—thanks to interest. That’s why carrying credit card debt is one of the most costly personal finance mistakes. It traps you in a cycle where banks profit and your wealth shrinks.

Credit cards can be powerful tools when used wisely, but treating them like “extra income” often leads to financial stress.

Why It’s a Problem

Carrying credit card debt hurts you in multiple ways:

- High interest rates: Most credit cards charge 20–30% annually, much higher than personal loans.

- Minimum payment trap: Paying just the minimum keeps you in debt for years.

- Credit score damage: High utilization ratios lower your score, making future borrowing expensive.

“According to LendingTree’s Q1 2025 data, among cardholders with unpaid balances, the average credit card debt is $7,321, up from $6,921 in Q1 2024. This is among the highest levels reported by LendingTree among this group.

Real-Life Example

Sneha, a 27-year-old designer, used her credit card to fund vacations and online shopping. She thought paying the minimum balance was “enough.” Over time, her ₹60,000 balance ballooned to nearly ₹95,000 due to interest. Once she switched to paying more than the minimum and cut unnecessary expenses, she became debt-free in 18 months.

Expert Insight

As Suze Orman puts it: “Credit card debt is the most expensive debt you can have, and it can destroy your financial future if left unchecked.”

How to Avoid This Mistake

- Always pay your balance in full if possible.

2. If you already have debt:

- Focus on the avalanche method (pay high-interest cards first).

- Or try the snowball method (pay smallest balances first for motivation).

3. Avoid unnecessary swipes—treat your credit card like cash, not bonus money.

4. Use balance transfer offers wisely, but only with a repayment plan.

4. Not Saving for Retirement Early

Imagine planting a tree. If you plant it today, it has decades to grow, bear fruit, and give shade. But if you wait until much later, you’ll always be playing catch-up. Retirement savings work the same way—the earlier you start, the easier it becomes to learn how to build wealth through the power of compounding. Unfortunately, not saving for retirement early is one of the most common personal finance mistakes people make.

When you delay, you miss out on years of growth. For example:

- If you invest $300/month starting at age 25 with a 7% return, by 65 you’ll have over $720,000.

- If you start at 35, you’ll end up with just around $340,000—less than half, even though you contributed almost the same amount.

That’s the magic of time.

The Real Picture

“According to the latest available U.S. Federal Reserve Survey of Consumer Finances (2022), households headed by someone aged 55-64 have a median retirement savings of about $185,000, which is better than many expect—but still may fall short of what many financial planners recommend for a comfortable retirement, especially especially when compared with Investopedia’s age-based retirement savings benchmarks.

Expert Insight

As Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving.” Starting early isn’t about being rich—it’s about making saving a habit.

What You Can Do

- Begin small—even $100 a month in your 20s grows significantly over time.

- Take advantage of retirement accounts like 401(k), IRA, or PPF (India) where you may get tax benefits.

- Automate your contributions so you never “forget” to save.

5. Overspending on Lifestyle Upgrades

Have you ever noticed how quickly “just one upgrade” turns into a new normal? Maybe it starts with moving to a bigger apartment, then dining out more often, then swapping your perfectly good phone for the latest model. This is called lifestyle inflation—and overspending on lifestyle upgrades is one of the most common money management mistakes.

At first, these upgrades feel harmless. You tell yourself, “I can afford it now, so why not?” But as income rises, expenses quietly expand to match, leaving little room for saving or investing. The danger isn’t the purchase itself—it’s the habit of constantly raising your cost of living.

The Numbers Don’t Lie

“Recent surveys find that 52-62% of Americans report living paycheck to paycheck, even among some higher earners. Meanwhile, around 25-26% of households now spend 95% or more of their income on necessities alone, according to Bank of America. These figures highlight how dangerous overspending and delayed saving can be.”

Real-Life Example

Consider two friends who both get a $10,000 annual raise:

- One keeps their expenses the same and invests the extra.

- The other upgrades to a luxury car with a $700 monthly payment.

After 10 years, the first friend could have an investment account worth over $140,000 (assuming 7% returns), while the second friend has nothing to show except a depreciating car.

Expert Wisdom

As financial advisor Ramit Sethi says, “You can’t out-earn stupid spending habits.” Wealth is not just about what you make—it’s about what you keep.

What You Can Do

- Cap lifestyle upgrades to 20–30% of new income; save or invest the rest.

- Differentiate between needs and status-driven wants.

- Create a “fun fund” so you enjoy small luxuries without derailing long-term goals.

6. Neglecting Insurance Coverage

Imagine working for years to build your savings—only to see it wiped out by a sudden medical emergency, car accident, or house fire. Neglecting insurance coverage is one of the most dangerous personal finance mistakes because it exposes you to risks that can instantly undo all your financial progress.

Why Insurance Matters

Insurance isn’t just an expense; it’s a safety net that protects your wealth. Whether it’s health, life, auto, home, or disability insurance, having the right coverage ensures you don’t face financial devastation when life throws the unexpected at you.

Real-Life Example

- A young family skips life insurance because they feel “too young” to need it. When the breadwinner unexpectedly passes away, the family is left with debt and no income support.

- Someone decides not to buy health insurance, thinking they’ll save money. A single hospital bill of $20,000+ puts them into long-term debt.

The Numbers Don’t Lie

“According to KFF and recent U.S. Census / ACS data, about 25-27 million Americans are uninsured (≈ 8% of people under 65). Among those who are insured, around 40-45% report that their health care premiums, deductibles, or other out-of-pocket costs are difficult to afford.

Expert Insight

“Insurance is not about getting a return; it’s about protecting what you cannot afford to lose.” — Suze Orman, financial advisor.

How to Avoid This Mistake

- Assess your needs: Health, life, disability, auto, and renters/home insurance. If you’re unsure where to start, check out this guide on essential insurance policies by Investopedia.

- Compare plans: Don’t just go with the cheapest; balance coverage with cost.

- Review annually: Update your policy as your income, family, or assets grow.

- Build it into your budget: Treat premiums like an essential bill, not an optional expense.

7. Failing to Track Net Worth

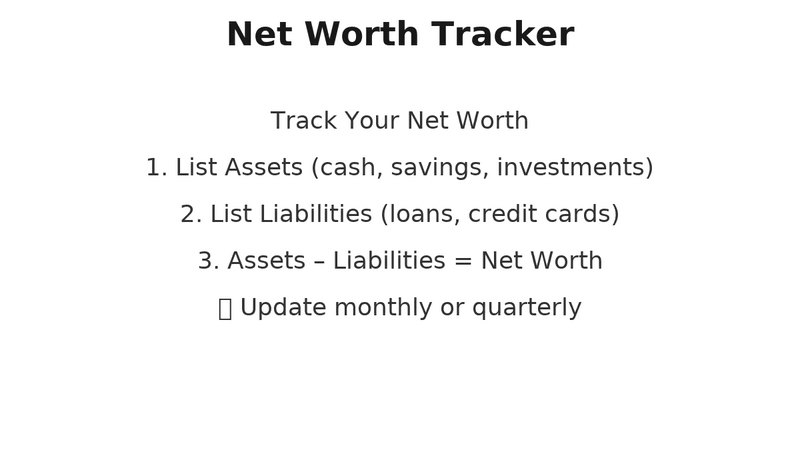

Have you ever wondered why, despite earning more each year, your bank account doesn’t seem to grow? That’s often because people focus only on income, not their net worth. Failing to track net worth is like running a race without knowing the distance—you may be moving, but you can’t tell if you’re actually getting closer to the finish line.

Why Net Worth Matters

Your net worth is the difference between what you own (assets) and what you owe (liabilities). It gives you a clear snapshot of your financial health. Without tracking it, you might assume you’re doing fine while debt quietly outweighs your assets.

Real-Life Example

- Someone earning $80,000 a year but carrying $60,000 in student loans and $10,000 in credit card debt may think they’re doing “well.”

- But when they calculate net worth, they realize it’s close to zero—or negative. This reality check can be the push they need to start paying down debt aggressively.

The Numbers Don’t Lie

“According to SmartAsset’s 2025 median net worth study, the U.S. median household net worth is approximately $187,690. Age-breakdowns from the most recent Survey of Consumer Finances (2022) show that households headed by someone aged 55-64 had a median net worth of about $364,270, and those aged 65-74 around $410,000. These figures underscore why regularly tracking your net worth is critical for long-term wealth growth.”

Expert Insight

“What gets measured gets managed.” — Peter Drucker. By keeping tabs on your net worth, you’re not just looking at numbers; you’re creating a map to financial freedom.

How to Track It Step by Step

- List your assets: Cash, savings, investments, real estate, retirement accounts.

- List your liabilities: Loans, mortgages, credit card balances, personal debts.

- Subtract liabilities from assets = your net worth. If you’re unsure, here’s a clear guide on how to calculate net worth from Investopedia.

- Update monthly or quarterly to see trends and progress.

8. Not Setting Financial Goals

Would you ever start a road trip without knowing your destination? Probably not. Yet many people do the same with their money. Not setting financial goals leaves you drifting—working hard, earning, and spending, but never moving toward a clear financial future.

Why Goals Matter

Financial goals act as your GPS. They give direction to your saving, investing, and spending habits. Without them, you may find yourself wondering why, after years of effort, you have little to show for it.

Real-Life Example

- Someone saves casually but without a target. They end up with $5,000 after years, but no emergency fund, no retirement savings, and no debt repayment plan.

- Contrast that with someone who sets specific goals: $10,000 emergency fund in 2 years, pay off $15,000 debt in 3 years, invest 15% of income for retirement. That clarity changes how they spend daily.

The Numbers Don’t Lie

“According to Schwab’s 2024 Modern Wealth Survey, 36% of Americans have a written financial plan. Among those who do, 76% say it gives them more control over their finances, and 96% say they feel confident they will reach their financial goals. There isn’t a confirmed number yet from the 2025 survey showing that plan-holding has dropped to 33%.”

Expert Insight

“Setting goals is the first step in turning the invisible into the visible.” — Tony Robbins.

How to Set Financial Goals Step by Step

- Define short-term goals: Build an emergency fund, pay off credit cards.

- Define medium-term goals: Buy a home, fund education, start a business.

- Define long-term goals: Retirement savings, financial independence.

- Make them SMART: Specific, Measurable, Achievable, Relevant, Time-bound. If you’re unsure where to start, check out how to set financial goals effectively from Investopedia.

- Review and adjust: Revisit your goals at least once a year.

9. Investment Mistakes: Making Emotional Decisions

Have you ever sold a stock in panic after a market dip—only to see it rebound the next week? That’s the danger of making emotional investment decisions. Fear and greed are two of the most powerful forces in money management, and they often push people in the wrong direction.

Emotions can cloud judgment and lead to three common mistakes:

- Panic selling during downturns

- Chasing hype (like meme stocks or sudden crypto rallies)

- Overconfidence after a few wins

For example, during the 2020 market crash, many retail investors sold their holdings at record lows—locking in losses—while long-term investors who stayed put saw their portfolios recover within months.

The Numbers Don’t Lie

“Recent behavioral finance research confirms that many retail investors underperform broad market benchmarks because of emotionally driven decisions. For example, MDPI’s 2025 simulation found that fear, overconfidence, and herd behavior lead to panic selling or holding losing positions. While passive buy-and-hold strategies typically outperform reactive trading over time, studies show emotions like fear and greed frequently disrupt investor discipline. To understand more, behavioral finance insights explain how these psychological biases affect investment choices and long-term performance.”

Expert Insight

As Warren Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.” This timeless advice underlines the need to stay rational when the market gets noisy.

How to Stay Rational

- Create an investment plan and stick to it.

- Automate contributions so you don’t have to time the market.

- Diversify holdings to reduce stress during volatility.

- Limit news consumption if it makes you anxious.

10. Neglecting Financial Education

Imagine trying to play a sport without ever learning the rules. That’s exactly what happens when people neglect financial education. Money is something we all use daily, yet many struggle because they were never taught the basics of budgeting, investing, or debt management.

Lack of financial education often leads to:

- Living paycheck to paycheck

- Overspending on credit cards

- Falling for scams or bad investments

- Not preparing for retirement

The Numbers Don’t Lie

“According to the 2025 TIAA Institute-GFLEC Personal Finance Index, U.S. adults answered only 49% of basic finance questions correctly—essentially unchanged since 2017. Gen Z performed worse, with an average of 38% correct answers. Among all functional areas, comprehending risk was weakest: adults averaged just 36% correct in that topic. These figures show why neglecting financial education can be so costly. To start building your foundation, you can explore financial literacy basics, which cover essential money skills like budgeting, saving, and investing.

Expert Insight

As Robert Kiyosaki, author of Rich Dad Poor Dad, once said: “Financial freedom is available to those who learn about it and work for it.”

How to Get Started with Financial Education

- Read beginner-friendly books/blogs on money management.

- Take free online courses on personal finance.

- Listen to finance podcasts during commutes.

- Follow credible news sources to understand markets.

Building wealth isn’t about chasing the next big thing—it’s about avoiding the small mistakes that silently erode your progress. Every smart choice you make today is a seed that can grow into financial freedom tomorrow.

FAQ (Frequently Asked Questions)

Q1. What’s the biggest personal finance mistake most people make?

The most common mistake is living without a budget. Without tracking where your money goes, it’s almost impossible to save or invest consistently.

Q2. How can I start fixing my finances if I’ve already made some of these mistakes?

Start small. Focus on one mistake at a time—like creating an emergency fund or paying down high-interest debt. Small wins build momentum.

Q3. Do I need a financial advisor to avoid these mistakes?

Not always. Many people succeed by learning the basics of personal finance themselves. However, a trusted advisor can provide guidance if your situation is complex.

Q4. How much should I save each month to build wealth?

A common rule is to save at least 20% of your income (50/30/20 rule). But even saving 5–10% consistently can make a big difference over time.

Call to Action (CTA)

Don’t wait for the “perfect moment” to start improving your finances—start today. Pick one area from this list, apply these financial freedom tips, take action, and stay consistent.

“And if crypto investing is on your radar, don’t miss my detailed post on what is Bitcoin? A beginner’s guide to first crypto.”