Table of Contents

1. Introduction – Why Spot Crypto ETFs Are Trending in 2025

In 2025, crypto is no longer the wild, unpredictable river it once was—Spot Crypto ETFs are the new bridges connecting everyday investors to digital assets with safety and simplicity.

- SEC’s Landmark Decision: The U.S. Securities and Exchange Commission has approved new rules that allow asset managers to launch spot-based cryptocurrency exchange-traded funds, as detailed in the SEC’s official press release on generic listing standards.

- True Ownership: Unlike older futures ETFs that only bet on price movements, a spot ETF actually holds real cryptocurrency (starting with Bitcoin and soon other coins).

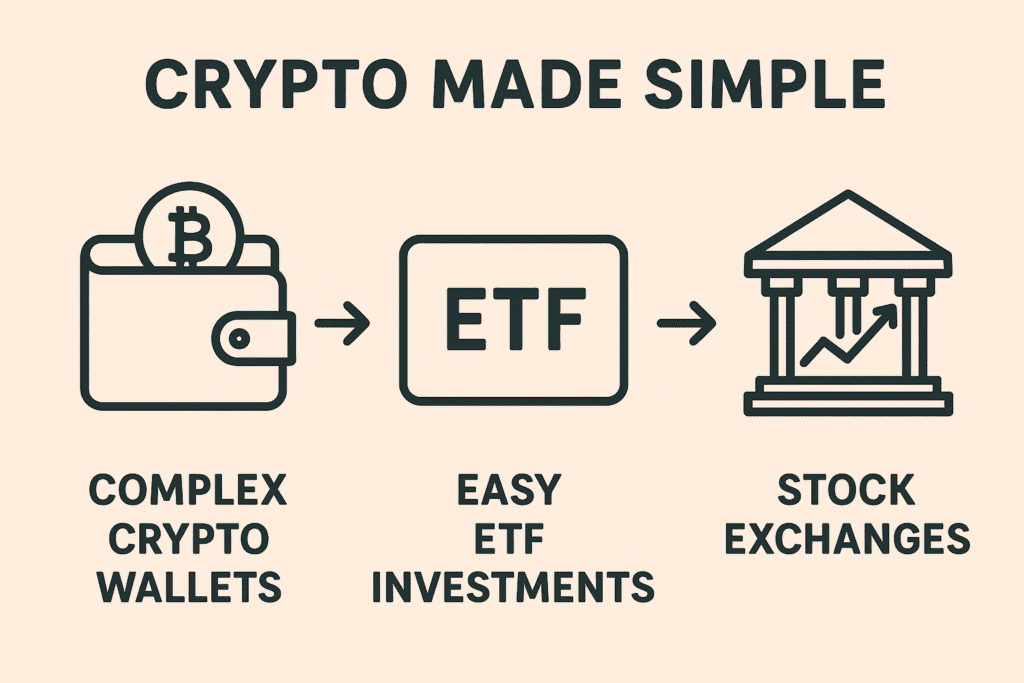

- Simplified Access: Investors can now buy Bitcoin through a standard brokerage account—just like purchasing a stock or gold ETF—without crypto wallets, recovery phrases, or complicated exchange setups.

- Wider Trust: This step signals that regulators and big financial institutions are finally giving crypto a structured, mainstream path.

If you’re curious about the foundation behind this change, read my guide What Is Bitcoin? to explore the roots of the first cryptocurrency before you dive into this new era.

“Spot ETFs are a gentle lantern guiding investors safely into the crypto market.”

“These ETFs act like a bridge, letting newcomers step into crypto without fear.”

2. What Are Spot Crypto ETFs?

A Spot Crypto ETFs is like a basket that directly holds cryptocurrency—most commonly Bitcoin—and trades on the stock market just like a regular share. Instead of opening a crypto exchange account or handling private keys, you can own a piece of this basket through a normal brokerage. It’s crypto investment made as simple as buying a mutual fund or gold ETF.

Think of it as visiting a fruit market. Instead of climbing a tree to pick mangoes yourself (managing wallets, passwords, exchanges), you simply buy a basket of fresh fruit that someone else carefully collects and keeps safe.

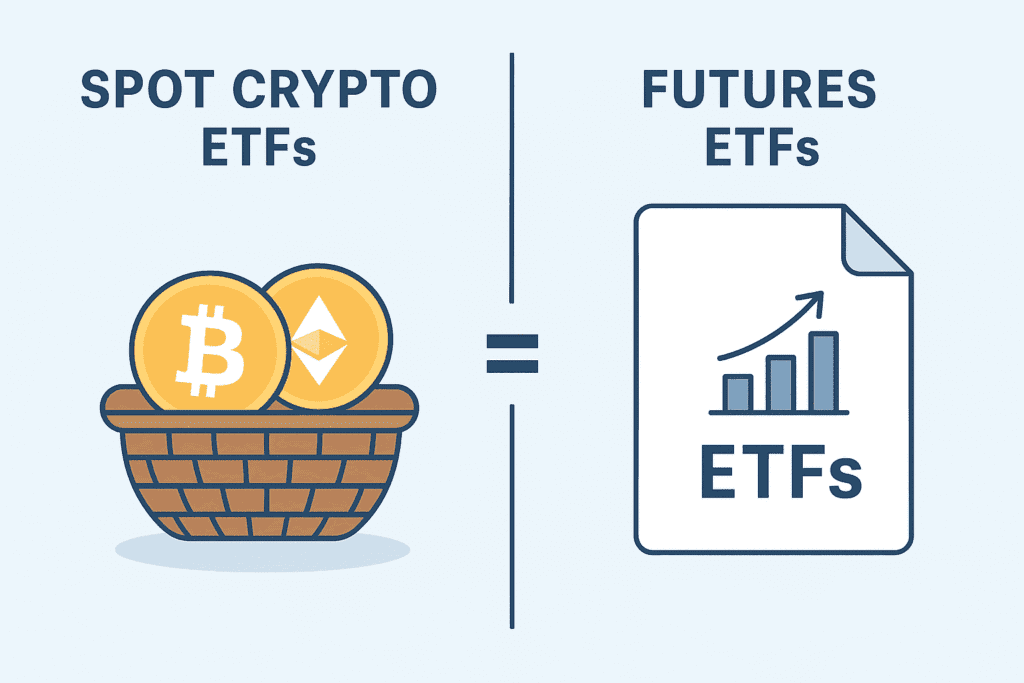

Difference Between Spot and Futures ETFs

The crypto world offers two main ETF types, but their paths are very different:

Spot ETFs:

- Backed by actual cryptocurrency held by the fund.

- Price moves in real time with the market.

- Similar to owning gold through a gold ETF—you indirectly hold the asset itself.

Futures ETFs:

- Track contracts predicting future crypto prices, not the coins themselves.

- Prices can drift away from real market value because they follow bets on where prices might go.

- Like buying a ticket to a future cricket match—you’re betting on the outcome, not holding the ball.

Spot ETFs are preferred by long-term investors because they mirror the real price of Bitcoin without speculative layers.

For a deeper explanation of how exchange-traded funds function in traditional markets, you can read Investopedia’s detailed guide on ETFs.

How Spot ETFs Work in Crypto Markets

- A fund manager buys and securely stores cryptocurrency (for example, Bitcoin) in a regulated custodian account.

- Shares of this fund are listed on traditional exchanges such as NASDAQ or NSE (if approved in your country).

- Investors purchase these shares through their regular brokerage, and each share reflects a slice of the underlying crypto holdings.

It’s like owning a room key to a treasure vault. You don’t touch the treasure directly, but you know your key represents a share of what’s inside.

Why Investors Care About Spot Crypto ETFs

- Ease of Access: No need for wallets, seed phrases, or crypto exchanges.

- Regulated Safety: Funds are managed under financial laws, giving investors a layer of trust.

- Market Growth: Institutional players—banks, pension funds, hedge funds—can participate, increasing liquidity and potentially stabilizing prices.

- Tax Simplicity: Gains and losses are reported like regular stock trades, avoiding complicated crypto tax filings.

“Truth is simple, but we insist on making it complicated.” Spot Crypto ETFs are the simple truth of crypto investing—removing the noise so anyone can step into the flow without fear of drowning in complexity.

3. The Role of the SEC and Regulatory Changes

Behind every major financial shift stands a gatekeeper.

For the crypto market in the United States, that gatekeeper is the Securities and Exchange Commission (SEC).

Its job is to protect investors, prevent fraud, and ensure that new products—like Spot Crypto ETFs—are safe enough for the wider public.

Think of the SEC as a careful gardener, trimming and shaping the branches so the tree of innovation can grow without harming anyone beneath its shade.

Recent SEC Rule Updates in 2025

Bitcoin’s spot ETF approvals are already a reality—the first funds began trading in early 2024.

But 2025 brought a second wave of changes designed to strengthen the system and prepare for other cryptocurrencies:

- Faster Approvals: Asset managers proposing spot ETFs for coins beyond Bitcoin can now apply under a streamlined review process.

- Proof-of-Reserve Standards: Every fund must provide transparent, real-time confirmation that the crypto it claims to hold is actually in secure custody.

- Institutional-Grade Security: Custodians are required to meet bank-level safety protocols before handling investor assets.

These updates are like adding sturdier railings to a bridge that Bitcoin already crossed—making it safer for the next travelers.

“For a detailed report on the original U.S. approvals, see Bloomberg’s article ‘SEC Authorizes Bitcoin-Spot ETFs in Crypto’s Breakthrough.”

Which Cryptos Could Get Spot ETFs Next? (Ethereum, Solana, others)

With Bitcoin’s bridge complete, attention now turns to the next contenders:

- Ethereum (ETH): The most likely candidate, thanks to its dominant smart-contract network and strong trading volumes.

- Solana (SOL): Known for speed and developer activity, though regulators may demand deeper security audits first.

- Litecoin (LTC) & Ripple (XRP): Both have long histories, but face different legal and liquidity hurdles.

The SEC is expected to favor coins with:

- High market stability

- Transparent governance

- Proven security records

It’s like selecting athletes for an Olympic team—only those with discipline, history, and clean records get to compete on the world stage.

Global Regulation Trends to Watch

Crypto regulation is not just an American story.

Other nations are shaping their own paths:

- European Union: Rolling out the MiCA framework to create continent-wide crypto rules.

- Japan: Encouraging institutional participation while tightening security standards.

- India & Southeast Asia: Experimenting with regulated crypto trading but keeping a close eye on taxation and consumer protection.

This worldwide movement shows that crypto is no longer a fringe experiment.

It is becoming a shared language of value, but each country adds its own accent.

The truth is not far away; it is just hidden behind our fear.”

Regulation, when done wisely, is not a barrier but a lamp—lighting the path so that curiosity can flow without fear of losing its way.

3. Benefits of Spot Crypto ETFs for Investors

Spot Crypto ETFs are like opening a window in a room that once felt locked.

They allow both new and seasoned investors to breathe easier while exploring the crypto world.

Here’s how these funds create opportunities without demanding deep technical skills or constant market watching.

Easier Access for Traditional Investors

Before Spot ETFs, investing in crypto meant setting up exchanges, wallets, and safeguarding private keys.

For many, this felt like walking through a maze with hidden doors.

- Simple Entry: Buy Bitcoin or other approved crypto through the same brokerage used for stocks or mutual funds.

- No Technical Barriers: No need to manage seed phrases, hardware wallets, or complex transfers.

- Familiar Process: Trades settle like ordinary shares, making crypto feel less intimidating to first-time buyers.

It’s like ordering water from a tap instead of digging your own well—the essence is the same, but the effort is far less.

Institutional Adoption and Market Growth

Spot ETFs do more than welcome retail investors; they also invite the giants of finance.

Banks, pension funds, and hedge funds—groups once hesitant about crypto—now have a regulated doorway.

- Higher Liquidity: Large institutions bring steady buying power, reducing wild price swings.

- Mainstream Legitimacy: Approval from regulators signals that crypto is no longer just a fringe experiment.

- Market Expansion: Broader participation can lead to more research, innovation, and new financial products.

Like a river joined by many streams, the market grows deeper and calmer as more participants flow in.

Tax & Security Advantages

Spot ETFs also simplify two of the most confusing parts of crypto: taxes and safety.

- Clear Tax Reporting: Gains and losses are handled like stock trades, making filings straightforward.

- Regulated Custody: Professional custodians safeguard the underlying crypto with bank-grade protections.

- Reduced Fraud Risk: SEC oversight lowers the chance of exchange hacks or sudden platform shutdowns.

Spot Crypto ETFs return to simplicity—offering exposure to digital assets while letting investors rest easy in a system they already understand.

For a comprehensive analysis of how different countries approach the taxation of virtual currencies, refer to the OECD’s report on Taxing Virtual Currencies.

4. Risks and Challenges of Spot Crypto ETFs

Every bridge has weight limits, and Spot Crypto ETFs are no exception.

While they open doors for investors, they also carry risks that need clear understanding before stepping in.

Awareness is the first shield—once you see the shadows, they lose the power to surprise you.

Regulatory Uncertainty

Crypto rules are still evolving, and governments can change course without much warning.

- Policy Shifts: A new law or political change could tighten rules or delay approvals for future ETFs.

- Cross-Border Differences: What is legal in the U.S. may face restrictions in Europe, Asia, or India.

- Compliance Costs: Fund managers must constantly update security and reporting standards, which can affect fees.

It’s like sailing on a river where the currents keep changing—steady for a while, then suddenly turning without notice.

Market Volatility and Price Manipulation Concerns

Even with a regulated wrapper, crypto remains a fast-moving market.

- Rapid Price Swings: Bitcoin and other coins can rise or fall by double digits in a single day.

- Whale Influence: Large holders can move prices with big trades, creating sudden ripples for ETF investors.

- Liquidity Gaps: During extreme moves, ETF prices might briefly drift from the actual crypto value.

Imagine trying to hold water in your hands—the form is beautiful, but it never stays still for long.

Limited Coverage Beyond Bitcoin

For now, most approved Spot ETFs focus almost entirely on Bitcoin.

- Few Choices: Ethereum and other coins are still waiting for regulatory green lights.

- Concentration Risk: Investors relying only on Bitcoin ETFs may miss opportunities in broader crypto markets.

- Innovation Gap: New projects and altcoins evolve faster than regulations can follow.

Like a garden where only one flower is allowed to bloom, the view is elegant but not yet complete.

“The mind always seeks security, but life is insecurity.”

Spot Crypto ETFs offer a safer path into crypto, but they cannot remove the natural uncertainty of a market that thrives on change.

5. What Spot ETFs Mean for Bitcoin and the Crypto Market

Spot ETFs are like opening the city gates for a currency that once lived only on the edge of town.

They invite a larger crowd—everyday investors, pension funds, and traditional banks—into a space once reserved for tech enthusiasts.

This quiet but powerful shift is already reshaping how the world sees Bitcoin and the broader crypto economy.

Wider Adoption and Everyday Access

- New Investors Arrive: People who avoided crypto because of wallets, private keys, or exchange risks can now buy through their regular brokerage accounts.

- Pension Funds & Banks Join In: Institutions once hesitant about digital assets now have a regulated, low-friction way to participate.

- Retail Confidence Grows: SEC approval signals that crypto is no longer an experimental playground but a recognized financial asset.

It’s like watching a small village grow into a bustling town—the same land, but suddenly filled with new life and movement.

Mainstream Credibility

- Regulated Recognition: SEC oversight frames Bitcoin as an asset worthy of Wall Street, not just internet forums.

- Media Shift: Headlines move from “Is crypto safe?” to “Which crypto ETF should you buy?”—a sign of acceptance.

- Institutional Standards: Custodians follow bank-grade security, reassuring cautious investors.

This credibility works like sunlight on a young tree, helping it grow stronger and more visible without changing its roots.

Future Price Effects

- Upward Pressure: Steady inflows from retirement funds and large portfolios can create long-term demand.

- Stabilization Over Time: Broader participation may reduce extreme price swings, though volatility will never vanish completely.

- Gateway to Altcoins: Success with Bitcoin ETFs may open doors for Ethereum and other networks, expanding the entire market.

Prices will still dance, but the dance floor is becoming larger and less fragile.

“When you allow existence to flow, it finds its own balance.”

Spot ETFs are not a promise of riches—they are a pathway where crypto can grow naturally, beyond fear and speculation, into a mature financial ecosystem.

6. Future Outlook – Will Spot ETFs Drive Mass Adoption?

The arrival of Spot Crypto ETFs feels like the first sunrise after a long night.

Bitcoin has already stepped into this light, and other cryptocurrencies are waiting at the edge of the horizon.

But will these new financial bridges truly carry crypto into every household and retirement plan, or will the journey remain slow and uneven?

Expert Opinions and Market Signals

- Steady Capital Inflows: Research groups like Bloomberg Intelligence estimate billions of dollars in yearly inflows as pension funds and mutual funds gradually add exposure.

- Liquidity Growth: Trading volumes are expected to rise, making it easier to buy or sell without sudden price gaps.

- Gradual Mainstreaming: Experts warn that while ETFs bring legitimacy, mass adoption depends on education and continued regulatory clarity.

It’s like planting a forest—each seed matters, but true shade takes time.

My Analysis of the Road Ahead

Spot ETFs will likely accelerate adoption in layers, not in one dramatic leap.

- Short Term (1–2 Years): Bitcoin ETFs continue to attract institutional money, while Ethereum and a few large-cap coins fight for approval.

- Medium Term (3–5 Years): More countries introduce similar products, creating a global network of regulated crypto access.

- Long Term (5+ Years): ETFs become part of standard retirement portfolios, shifting crypto from a speculative asset to a core financial tool.

This is not a sprint; it is a river slowly deepening its own course.

Spot ETFs are not the destination—they are the process itself.

They make crypto easier, safer, and more trusted, but mass adoption will come only as people understand the value beyond price charts.

Like a candle lighting another candle, each new investor expands the circle of awareness.

The glow spreads quietly, until one day the room is bright and no one remembers when the darkness began.

7. Conclusion – Should You Care About Spot Crypto ETFs?

Spot Crypto ETFs are more than a new investment product—they are a doorway.

They take something once hidden behind technical walls and place it inside the familiar world of stock markets and retirement plans.

Whether you are a curious beginner or a cautious investor, their arrival is worth noticing.

- Simpler Entry: You can now gain exposure to Bitcoin and other approved cryptos without managing wallets or private keys.

- Regulated Environment: SEC oversight provides clearer rules, reducing the fear of scams or sudden exchange failures.

- Growing Opportunity: Institutional interest may bring more stability and open the path for Ethereum or other coins in the future.

Yet, this path is not free of clouds.

Prices remain volatile, regulations can shift, and most ETFs currently focus only on Bitcoin.

Investing through an ETF does not eliminate the fundamental risks of the crypto market—it simply offers a safer and more convenient way to participate.

“The real question is not whether life exists after death. The real question is whether you are alive before death.”

The same applies here: the question is not whether ETFs will make you rich, but whether you understand what you are investing in.

Spot Crypto ETFs invite you to explore crypto with open eyes.

Care for them not because they promise certainty, but because they signal that digital assets are quietly stepping into the mainstream, shaping a financial future that is already unfolding around you.

Quick Recap of Key Points :

- Spot Crypto ETFs Simplify Access:

- Let investors buy Bitcoin and other approved cryptos through regular brokerage accounts—no wallets, private keys, or exchange hassles.

- Regulation Brings Credibility:

- SEC oversight provides clearer rules, safer custody, and wider acceptance from banks, funds, and retail investors.

- Benefits for Investors:

- Easier entry, institutional participation, potential tax clarity, and stronger market liquidity.

- Key Risks Remain:

- Crypto prices stay volatile, regulations can shift, and most ETFs still focus mainly on Bitcoin.

- Market Impact:

- Wider adoption, higher trading volumes, and a path for future ETFs on Ethereum and other major coins.

- Future Outlook:

- Growth will be gradual—mass adoption depends on global regulatory clarity and investor education, not quick hype.

Spot Crypto ETFs are a bridge between traditional finance and digital assets—steady, regulated, but still carrying the natural unpredictability of crypto markets.

FAQs on Spot Crypto ETFs

Q1. What exactly is a Spot Crypto ETF?

A Spot Crypto ETF is a regulated fund that directly holds a cryptocurrency—like Bitcoin—and trades on stock exchanges.

Investors get crypto exposure without handling wallets or private keys.

Q2. How is it different from a Futures ETF?

A Spot ETF tracks the current market price of the crypto it holds, while a Futures ETF follows contracts that bet on future prices.

This makes Spot ETFs simpler and often closer to the real market value.

Q3. Is investing in a Spot Crypto ETF safe?

It’s safer than buying crypto on unregulated exchanges because it follows SEC rules and uses secure custodians.

However, crypto prices remain volatile, so market risk still exists.

Q4. Will Ethereum or other coins get Spot ETFs next?

Analysts expect Ethereum to be next in line, but approvals depend on ongoing regulatory reviews and market readiness.

Call to Action (CTA)

Ready to explore the future of investing?

Start by learning, not rushing—read my detailed guide on [What is Bitcoin?] for a strong foundation, then track the latest Spot ETF launches.

When you invest, begin small, stay curious, and let awareness guide your moves.

“Move in awareness, and even risk becomes a path to freedom.”

![Read more about the article What Is Cryptocurrency and How Does It Work in India? [2025 Beginner’s Guide]](https://cryptomonkx.com/wp-content/uploads/2025/10/what-is-cryptocurrency-and-how-does-it-work-in-india-featured-image-300x200.png)