Do you ever wonder why your paycheck seems to vanish before the month ends, even though you don’t remember buying anything major? That’s what happen when you are living without a budget and you’re not alone.

According to Bankrate’s 2025 Emergency Savings Report, many Americans are still living without a budget—only 46% have enough savings to cover three months of expenses, while 24% have no emergency savings at all.

Many people believe budgeting is restrictive or boring. In reality, it’s one of the most important money management tips for financial freedom. A budget doesn’t cut out fun—it gives your money direction. The benefits will far outweigh the risks of living without a budget—and help you avoid the biggest personal finance mistakes.

Let’s uncover the 7 hidden dangers of living without a budget—and how you can avoid them with practical strategies.

Table of Contents

1. Living Paycheck to Paycheck

One of the biggest consequences of not budgeting is staying stuck in a paycheck-to-paycheck cycle.

Real-life example: Sarah earns $4,500 a month. After paying rent, dining out, and shopping online, she has less than $100 left by the 25th. Every small expense feels stressful because she has no cushion.

Why it happens: Lifestyle creep. As income grows, expenses rise with it—unless you track your expenses.

Quick Fix (Action Plan):

- Follow the 50/30/20 rule → 50% needs, 30% wants, 20% savings.

- Use apps like YNAB, Mint, or Goodbudget to track and categorize spending.

- Automate savings on payday so you save first, not last.

The 50/30/20 rule is a simple way to stop living without a budget and finally gain control of your money.

Key takeaway: Without budgeting, you’ll always survive—but never build wealth.

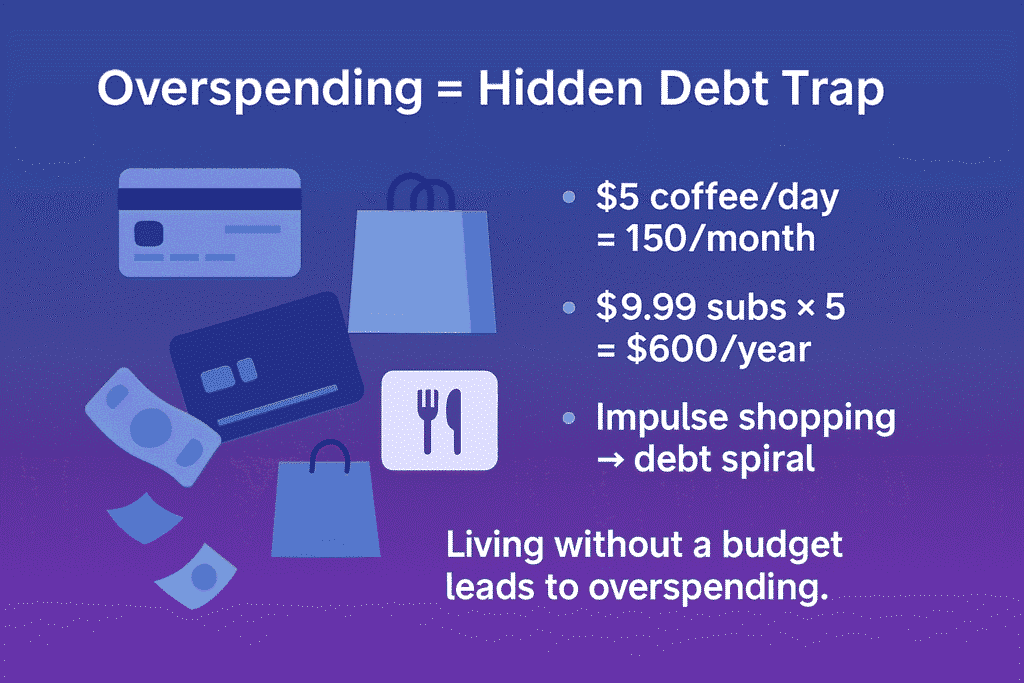

2. Overspending on Non-Essentials

When you’re spending without a plan, it’s easy to lose track of “small” luxuries.

Example: That $9.99 Netflix subscription, $5 daily latte, and $40 weekend Uber Eats order might not feel like much—but together, they can easily cost $500 a month. That’s $6,000 a year—enough for a vacation or an investment portfolio.

Why it happens:

- Instant gratification: Buying gives your brain a dopamine hit, tricking you into thinking small spends don’t matter.

- Comparison with others: People naturally compare themselves—whether it’s clothes, fashion, or the latest phone. This pressure makes you spend money just to impress.

But here’s the harsh truth: people lose interest in your new shirt or phone within minutes. You end up broke, and all you get is a short-lived “Wow, nice phone” before they move on. Your empty bank account stays long after the compliments fade.

This is one of the worst personal finance mistakes—using money to please others instead of securing your own future.

Quick Fix (Action Plan):

- Before buying, ask: Am I doing this for me, or for others?

- Set a monthly “fun budget” so you can enjoy guilt-free luxuries without overspending.

- Focus on financial discipline—redirect comparison energy into saving and investing.

Key takeaway: Stop pleasing others. It’s a financial disaster, and living without a budget only makes it worse.

3. Falling Into Debt

Among all financial planning mistakes, relying on credit cards to cover overspending is the most damaging.

Example: Many people fall into credit card debt simply because they are living without a budget. With the average credit card APR now hovering around 21–24% in the U.S., carrying a balance can cost thousands in interest.

Why it happens: Swiping plastic feels painless compared to handing over cash. The brain registers less “pain,” making overspending effortless. Many people fall into debt simply because they are living without a budget to guide their spending.

Quick Fix (Action Plan):

- Use the debt avalanche method: pay off high-interest debt first.

- Avoid “buy now, pay later” schemes unless you have the cash already.

- Make debt repayment a non-negotiable line in your budget.

Key takeaway: Debt doesn’t just drain money—it drains peace of mind.

4. No Emergency Cushion

The importance of an emergency fund cannot be overstated. Life is unpredictable—medical bills, job loss, or car repairs can strike anytime.

Example: James’s car broke down, repair cost $600. With no savings, he put it on a credit card, adding to his debt. If he had just $1,000 saved, the situation would have been stress-free.

Without an emergency fund, those living without a budget are hit hardest when life throws surprises. Bankrate also found that 37% of Americans tapped into emergency savings within the past year, proving how essential a safety net is.

Why it happens: People assume emergencies are rare. But in reality, they’re inevitable.

Quick Fix (Action Plan):

- Start small: save $50–$100 weekly in a separate savings account.

- Build toward 3–6 months of living expenses.

- Automate transfers so saving doesn’t rely on willpower.

Key takeaway: Without budgeting, building an emergency fund feels impossible. Every bump in the road becomes a crisis for those living without a budget.

5. Missed Financial Goals

Without structured planning, dreams like buying a home, traveling abroad, or retiring comfortably remain out of reach.

Example: Emily wanted to save for a house down payment in 5 years. But without a budget, her raises went toward vacations and gadgets. Meanwhile, her friend who budgeted consistently had enough saved for a mortgage.

Why it happens: Goals without a plan are just wishes. A budget turns them into reality.

Quick Fix (Action Plan):

- Create separate savings accounts or sinking funds for each goal (home, travel, retirement).

- Automate monthly transfers so progress happens in the background.

- Review progress every 6 months for motivation.

Key takeaway: The benefits of budgeting lie in turning dreams into achievable goals, while living without a budget keeps you stuck in wishful thinking.

6. Constant Financial Stress

Money is the #1 cause of relationship conflicts worldwide. When you’re living without a budget, uncertainty creates constant anxiety.

Example: Couples often argue over “where the money went.” Without clear tracking, blame replaces facts, and financial stress damages relationships.

Why it happens: Not knowing if you can cover bills or save creates background stress that never leaves.

Quick Fix (Action Plan):

- Hold a monthly money check-in—alone or with your partner.

- Use tools like Google Sheets or shared apps to track spending together.

- Plan big expenses (holidays, gadgets) months in advance.

Key takeaway: Budgeting isn’t just financial—it’s emotional self-care.

7. Lack of Financial Growth

The biggest hidden danger of living without a budget is stagnation. You may earn well, but if you don’t save or invest intentionally, wealth never grows.

Example: Investing $200/month in an index fund for 15 years could grow to $60,000–$70,000. Without budgeting, that money disappears into Amazon orders and takeout—never to return.

Why it happens: High income is often mistaken for financial success. But true success is growing net worth, not just spending more.

Quick Fix (Action Plan):

- Pay yourself first: automate investments (401(k), IRA, index funds).

- Track your net worth quarterly.

- Redirect bonuses, tax refunds, and raises into savings instead of lifestyle upgrades.

Key takeaway: Income is temporary—wealth is permanent. And without a plan, living without a budget keeps you stuck forever—making it harder to escape the 9-5 grind.

Conclusion: Why Budgeting Is Essential

At first glance, living without a budget feels easy. But in reality, it’s financial quicksand—keeping you stuck in debt, stress, and missed opportunities.

The benefits of budgeting are clear:

- Peace of mind

- Financial discipline

- Progress toward long-term goals

Remember—a budget doesn’t restrict you; it empowers you. It’s the roadmap that takes you from financial chaos to financial freedom. To speed this journey, learn these essential financial freedom skills.

Start today: track your expenses for one month, automate savings, and set one simple goal. The benefits will far outweigh the risks of living without a budget.

FAQs About Living Without a Budget

Q1. What happens if you don’t budget your money?

You’re likely to overspend, fall into debt, live paycheck to paycheck, and miss financial goals.

Q2. Why is budgeting important for financial success?

Budgeting ensures clarity, reduces stress, and directs money toward savings, investments, and meaningful goals.

Q3. How do I stop living paycheck to paycheck?

Track expenses, cut non-essentials, and use a method like 50/30/20. Automate savings before spending.

Q4. What are the most common budgeting mistakes?

Not tracking expenses, ignoring emergency funds, relying on debt, and overspending to please others.

Q5. How do I create a simple budget as a beginner?

Track one month of spending, categorize into needs/wants/savings, set realistic limits, and review monthly.