Cryptocurrency sounds like a big and scary word, but it’s not that hard to understand. Imagine you have money, like coins or notes, but instead of keeping them in your wallet or pocket, they only live inside your phone or computer. That’s what cryptocurrency is — it’s digital money.

Now, the special thing about cryptocurrency is that no single bank or government controls it. Instead, people all around the world use computers to keep track of who owns what. This system is called the blockchain, and it works like a giant notebook that everyone can see, but no one can cheat.

In India, many people are curious about cryptocurrency: What is cryptocurrency and how does it work in India? Is it legal? Can you invest in it? How is it different from the money we use every day?

In this blog, we’ll explain everything step by step in simple words so that even if you are new, you’ll easily understand:

- What cryptocurrency is

- How it actually works

- What the rules are in India (legal and tax)

- How you can start safely as a beginner

Let’s start this journey and discover how cryptocurrency works in India.

Table of Contents

1. What Is Cryptocurrency and How Does It Work In India?

Cryptocurrency is a type of money that is fully digital. You cannot hold it in your hands like paper rupees or coins, because it exists only on the internet. People use it to send and receive payments online, anywhere in the world, often much faster than a bank transfer.

The special part is that cryptocurrency is not issued or controlled by the Reserve Bank of India or any government. Instead, it works on a technology called the blockchain. You can imagine blockchain as a public record book, stored on thousands of computers at the same time. Every transaction is written in this record, and because everyone can see and verify it, cheating or duplicating becomes nearly impossible.

Now, many beginners think cryptocurrency and Bitcoin mean the same thing. That’s not true:

- Bitcoin was the first cryptocurrency, launched in 2009.

- Cryptocurrency is the bigger category, which includes thousands of coins like Ethereum, Solana, and Ripple.

So, when people search for what is cryptocurrency and how does it work in India, they are really asking: what makes this digital money different from regular rupees, is it legal here, and how can they use or invest in it safely?

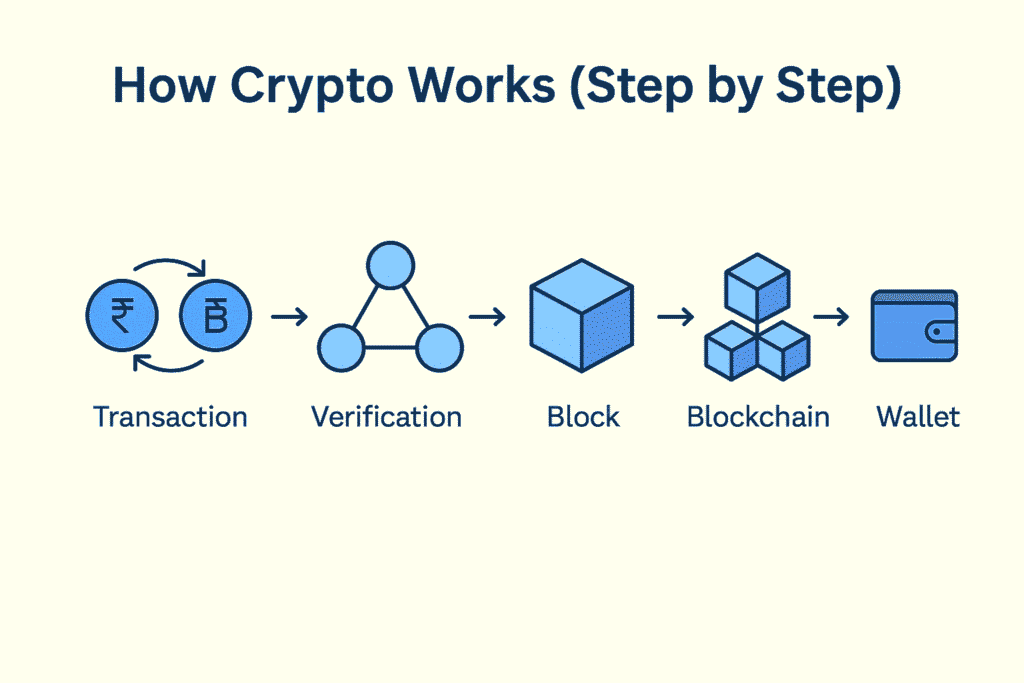

2. How Does Cryptocurrency Work Step by Step?

Think of cryptocurrency like playing an online multiplayer game. Everyone in the game has the same scoreboard, and whenever a player scores points, the change is shown to all players at once. Nobody can secretly add extra points, because everyone is watching and the scoreboard updates for everyone together.

Here’s how cryptocurrency works in a similar way:

- A Transaction Begins

When you send coins to someone, it’s like scoring points — the request is shared with the whole network. - The Network Checks

Thousands of computers (called nodes) confirm if you really have those coins. This makes sure nobody can “double spend” the same money. - Adding to the Chain

Once confirmed, the transaction is grouped with others into a block. That block is then linked to previous blocks, creating the blockchain. - Shared Record for All

Just like every player sees the same scoreboard, every computer in the network keeps a copy of the blockchain. It’s open, transparent, and very hard to cheat. - Digital Wallets and Keys

To hold your coins, you use a digital wallet. It gives you a private key, like a secret password, which proves that the coins belong to you.

So, cryptocurrency works through this shared scoreboard system called blockchain. Transactions are checked, recorded, and stored across the world — making it reliable without needing banks or middlemen.

3. Cryptocurrency in India – Legal Status (2025)

The legal position of cryptocurrency in India has always created confusion. People often ask: “what is cryptocurrency and how does it work in India if the laws are not clear?” To understand this, think of cryptocurrency like a foreign language in India.

- People can learn and use it (there is no ban).

- But it is not officially recognized as Hindi or English (not an official legal tender).

- This means you can invest, trade, or hold cryptocurrency, but you cannot walk into a shop and pay directly with it like you do with rupees.

Now, let’s look at how the law has actually evolved:

- Supreme Court Ruling (2020)

In 2018, the Reserve Bank of India (RBI) told banks not to deal with crypto businesses, which made trading almost impossible. But in March 2020, the Supreme Court struck down this ban, saying it was unfair. This gave people confidence to start using and investing in crypto again. - RBI’s Current Stance

“The RBI still does not consider cryptocurrency as legal money. It regularly warns about risks like scams and volatility. At the same time, it is piloting the e-Rupee (Central Bank Digital Currency) in retail since December 2022.” - “Legal but Not Legal Tender”

Cryptocurrency is not banned in India. You can legally buy, sell, and hold it. But it is not legal tender, which means you cannot use it the same way as rupees to settle everyday payments.

So, cryptocurrency in India sits in a grey area — you are free to own and trade it, but it doesn’t have the same legal power as the Indian rupee. For beginners trying to learn what is cryptocurrency and how does it work in India, this means you can treat it as an asset or investment, not as day-to-day money.

4. Cryptocurrency Tax in India

After learning what is cryptocurrency and how does it work in India, the next important topic is taxation. The Indian government has set very clear rules for crypto, and every trader or investor needs to know them.

Think of it like train tickets. No matter how short or long your journey is, you always have to buy a ticket before boarding. Similarly, whenever you trade or profit from cryptocurrency in India, a part of it must go to the government as tax.

- 30% Flat Tax on Profits

Any profit you make by selling cryptocurrency is taxed at a flat 30% rate (plus surcharge and cess). It doesn’t matter whether your profit is small or big — the rate stays the same. - 1% TDS on Every Transaction

“On top of this, 1% TDS (Tax Deducted at Source) is cut on the sale value of each trade (Section 194S). Most exchanges deduct it automatically, even if you make no profit.” - Getting TDS Back

The good news is that this TDS is not an “extra tax.” When you file your Income Tax Return (ITR), the deducted TDS is shown in your Form 26AS/AIS. It can then be adjusted against your final tax liability, and if the deducted amount is more than what you owe, you can even get a refund. “Under Section 115BBH, losses from one cryptocurrency cannot be set off against gains from another or any other income, and they also cannot be carried forward to future years.” - Example Scenario

- You buy Bitcoin for ₹20,000 and later sell it for ₹30,000.

- Profit = ₹10,000.

- Tax on profit = ₹3,000 (30%).

- TDS = 1% of ₹30,000 = ₹300 (already deducted by the exchange).

- At ITR filing, this ₹300 is adjusted, so you only pay ₹2,700 more.

- If you made no profit (say you sold at a loss), the ₹300 TDS could be refunded.

In simple words: Cryptocurrency in India is taxed heavily. You pay 30% on profits and 1% TDS on every trade. But by filing your taxes properly, you can adjust or even claim back part of the TDS.

5. How to Invest in Cryptocurrency in India

After understanding what is cryptocurrency and how does it work in India, the next step is knowing how to invest safely.

- Exchanges in India

The most common way to buy cryptocurrency in India is through exchanges like WazirX, CoinDCX, ZebPay, and Bitbns. These apps allow you to deposit INR and purchase coins such as Bitcoin, Ethereum, or others.

But from my personal experience, Indian exchanges are not always reliable. Sometimes deposits or withdrawals are delayed, and in some cases, transactions are even paused without notice.

“On top of that, these platforms are not fully hack-proof — for example, WazirX suffered a major hack in July 2024 (~$230M), and CoinDCX reported a breach of an internal account in July 2025 (~$44M), though they said user funds were safe and losses were covered.” - Using Global Platforms (Binance P2P)

Many Indian users also rely on Binance, which is a global exchange, not an Indian one. Binance allows buying USDT (a stablecoin) in INR through its P2P service, and then you can trade that for other cryptocurrencies. “Binance, though a global platform, is now registered with FIU-IND and follows Indian AML/KYC regulations under PMLA, which means Indian users can legally use its P2P and trading services.” - Wallets for Safety

If you really want to secure your crypto, don’t keep it all on exchanges. Use a crypto wallet instead. A wallet gives you full control of your private keys, which means no exchange can block or freeze your funds. Options include hardware wallets like Ledger or software wallets like Trust Wallet. - Minimum Investment

The entry barrier is very low. You can start investing with as little as ₹100 on Indian apps. But my personal advice is to start small, learn how the system works, and then increase your investment only if you are comfortable.

From my perspective, investing in cryptocurrency in India is possible and easy to start, but the platforms are not fully safe. Exchanges like WazirX and CoinDCX are convenient but sometimes unreliable, and even global platforms like Binance come with their own risks. The safest step for beginners learning what is cryptocurrency and how does it work in India is to start small and move your coins to a secure wallet instead of trusting apps blindly.

6. Future of Cryptocurrency in India

After learning what is cryptocurrency and how does it work in India, the next question most people have is about the future. Will crypto really grow here, or will the government ban it?

- Adoption Trends

Even though crypto is not legal tender, adoption in India is rising fast. Young people, freelancers, and even small businesses are using crypto for trading, investments, and sometimes for international payments. “According to Chainalysis 2025, India ranks #1 globally in crypto adoption, with millions of users actively trading and holding coins.” - Web3 & Blockchain Startups

“Beyond coins like Bitcoin or Ethereum, India is also becoming a hub for Web3 projects, with 3200+ startups building apps in gaming, NFTs, DeFi, and supply chain.”. This shows that crypto is not only about trading — it is also about new technology and opportunities for jobs and businesses. - Government Regulation Expected

Right now, cryptocurrency in India is in a grey zone: it’s legal to hold and trade, but not recognized as legal tender. The government has already introduced a 30% tax and 1% TDS, which means they are not banning it — they are regulating it. In the coming years, we can expect clearer rules on exchanges, wallets, and even investor safety.

In short: The future of cryptocurrency in India looks promising, but it will depend heavily on how the government builds regulations. One recent example of evolving regulation is in the US, where Spot Crypto ETFs were approved in 2025. If you want to understand how ETFs work, read our full guide: Spot Crypto ETFs Guide 2025: SEC Regulations, Benefits, and Risks Explained.”

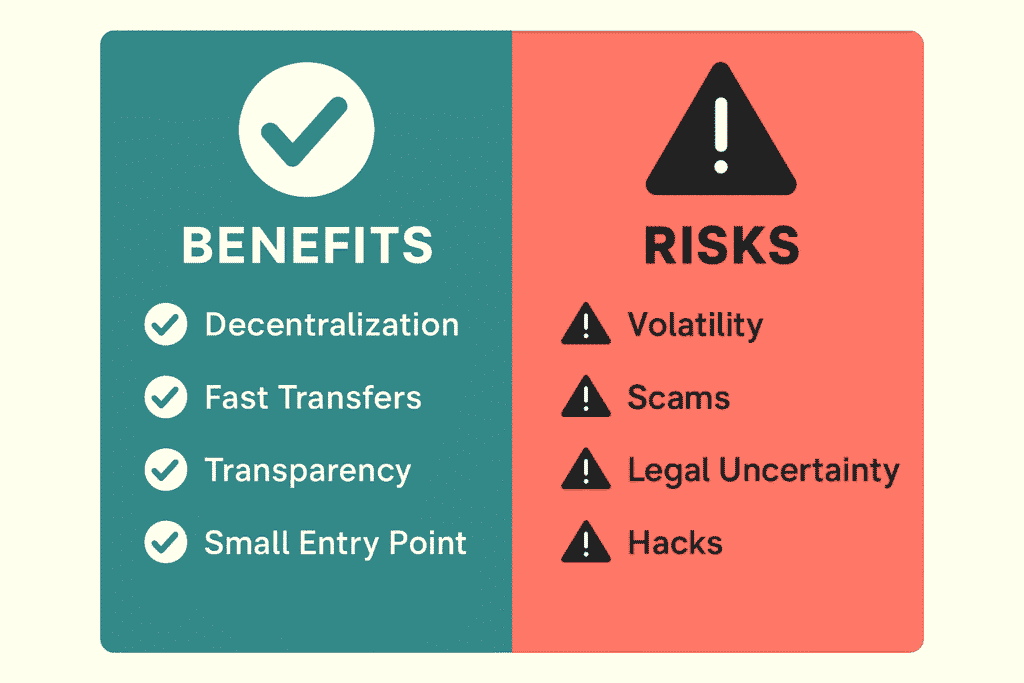

7. Benefits and Risks of Cryptocurrency

If you are trying to understand what is cryptocurrency and how does it work in India, it’s not enough to know only the basics. You must also know both the benefits and risks before putting your hard-earned money into it.

Benefits :

- Decentralization: No single bank, company, or government controls cryptocurrency. This gives more freedom to users.

- Fast Transfers: You can send money across the world in minutes, often cheaper than using a bank.

- Transparency: Every transaction is recorded on the blockchain, so cheating is very difficult.

- Small Entry Point: You can start investing with as little as ₹100 in India.

Risks :

- Volatility: Crypto prices go up and down very fast. A coin can rise 20% in a day and fall 50% the next week.

- Scams: Fake coins, Ponzi schemes, and rug pulls are common. Beginners often lose money by trusting the wrong projects.

- Legal Uncertainty: In India, crypto is not banned but also not fully legal. Future regulations can change how you invest.

- Exchange Safety: “Indian apps like WazirX and CoinDCX sometimes face delays and payment issues, and they have also faced major security breaches in 2024 and 2025. This makes them risky for long-term storage.”

To stay safe:

- Always start with small investments.

- Use hardware or trusted wallets instead of leaving all your money on exchanges.

- Do your own research (DYOR) before buying any coin.

- And never invest money you cannot afford to lose.

FAQs (Frequently Asked Questions)

Q1. Is crypto money real money?

Yes, cryptocurrency is real money but in a digital form. It can be used for online payments and trading, but in India it is not legal tender like the rupee — you cannot use it everywhere for daily purchases.

Q2. Can I invest ₹1000 in cryptocurrency?

Yes, you can start with as little as ₹100, so ₹1000 is more than enough for beginners. But always start small, learn how it works, and never invest money you cannot afford to lose.

Q3. Is it safe to invest in cryptocurrency in India?

Crypto is allowed in India, but it is not risk-free. Prices are very volatile, exchanges sometimes face issues, and scams are common. The safest way is to use trusted apps, move your coins to a private wallet, and invest only small amounts.

Q4. Is crypto better than stocks?

Crypto can give higher returns in a short time, but it also carries much higher risk compared to stocks. Stocks are regulated in India by SEBI, while crypto has uncertain rules. For stability, stocks are better; for high risk–high reward, crypto attracts many.

Q5. How much money should a beginner invest in cryptocurrency?

A beginner should start with a very small amount — even ₹500–₹1000 is enough to learn. The goal at first is to understand how crypto works, not to chase quick profits.

Q6. Which crypto app is legal in India?

Apps like WazirX, CoinDCX, ZebPay, and Bitbns operate legally in India under tax rules. Global platforms like Binance are also used, but Indian users should be careful about regulations and always file taxes.

Q7. What is the biggest risk in crypto?

The biggest risk is volatility — prices can crash suddenly. Other risks include scams, hacks, and legal uncertainty in India. Beginners should invest carefully and use wallets for safety.

Q8. Which is the no. 1 crypto?

“The number one cryptocurrency in the world is Bitcoin. It was the first digital currency (launched in 2009) and still has the highest market capitalization among all coins.”

![You are currently viewing What Is Cryptocurrency and How Does It Work in India? [2025 Beginner’s Guide]](https://cryptomonkx.com/wp-content/uploads/2025/10/what-is-cryptocurrency-and-how-does-it-work-in-india-featured-image-scaled.png)